29

2016 ANNUAL REPORT

an increase in the frequency of pricing

adjustments caused by delays, which

now occur on a bimonthly basis rather

than on a semiannual basis.

Operating profits maintained an upward

trend as at September 30

th

(after the

stabilization of the price differentials

exhibited in the last few months), rising

to $2 million just before the start of Q4

2016, in stark contrast to the company’s

Net Profits, which fell to negative $11

million.

The net profit margin for the year closed

at +0.53% as at December 2016, up

from -0.81% in December 2015. The

year, however, closed with a fiscal deficit

which was ameliorated by a deferred

income tax of $5 million. The company

reported a net operating loss of $52

million in its year-end Comprehensive

Income statement.

In view of the accounting entry

adjustments required after the

revaluation of assets, and following

the analysis of the audited statement

of financial condition, the company’s

book loss grew by $15 million due to

the construction of permanent projects;

this adjustment affected the “Retained

Earnings” accounting entry. In view

of the above, the company reported a

profit/loss of $52 million.

Balance Sheet

Total Assets

Total assets as at December 2016

decreased by $37 million, down by

2.27% in relation to 2015.

Current assets as at December 2016

grew $9 million, up by 1.43% in relation

to 2015. Current assets include: product

inventory; accounts receivable; and cash

and cash equivalents, as at December

2016.

Product inventory accounted for 68.54%

of the current assets and 13.11% (up

from 12.29% in 2015) of the total assets.

Before the revaluation of assets in 2015,

fixed assets accounted for 50% of the

total assets, current assets (which were

heavily influenced by the inventory

level of hydrocarbons) accounted for

46%, and other assets accounted for

the remaining 4%. After the revaluation

of assets, fixed and current assets grew

to 77% and 18%, respectively, due to

an increase in the inventory level of

hydrocarbons in 2016, which grew by

$16 million in relation to December

2015; this represents a 19% increase in

volume, not in price.

Total inventory (including materials)

grew by $9 million (4.32%), up from

$199 million in 2015 to $288 million in

2016 (as at December 31

st

). This increase

in inventory is mostly attributable to a

greater volume of imports and not to

the import price of hydrocarbons, as

the price of these products presented a

downward trend in 2016.

The average price per barrel of the CIF

value of import as at December 31

st

,

2016, was $53.12/bbl, down from

$64.15/bbl (-$11.03/bbl) in 2015.

Notwithstanding the above, the product

inventory in 2016 showed a drop of $2

million in relation to the previous year.

All but two of the products, Premium

40%

35%

30%

25%

20%

15%

10%

5%

0%

FEB MAR APR MAY JUN JUL AUG SEPT OCT NOV DEC

JAN-2016

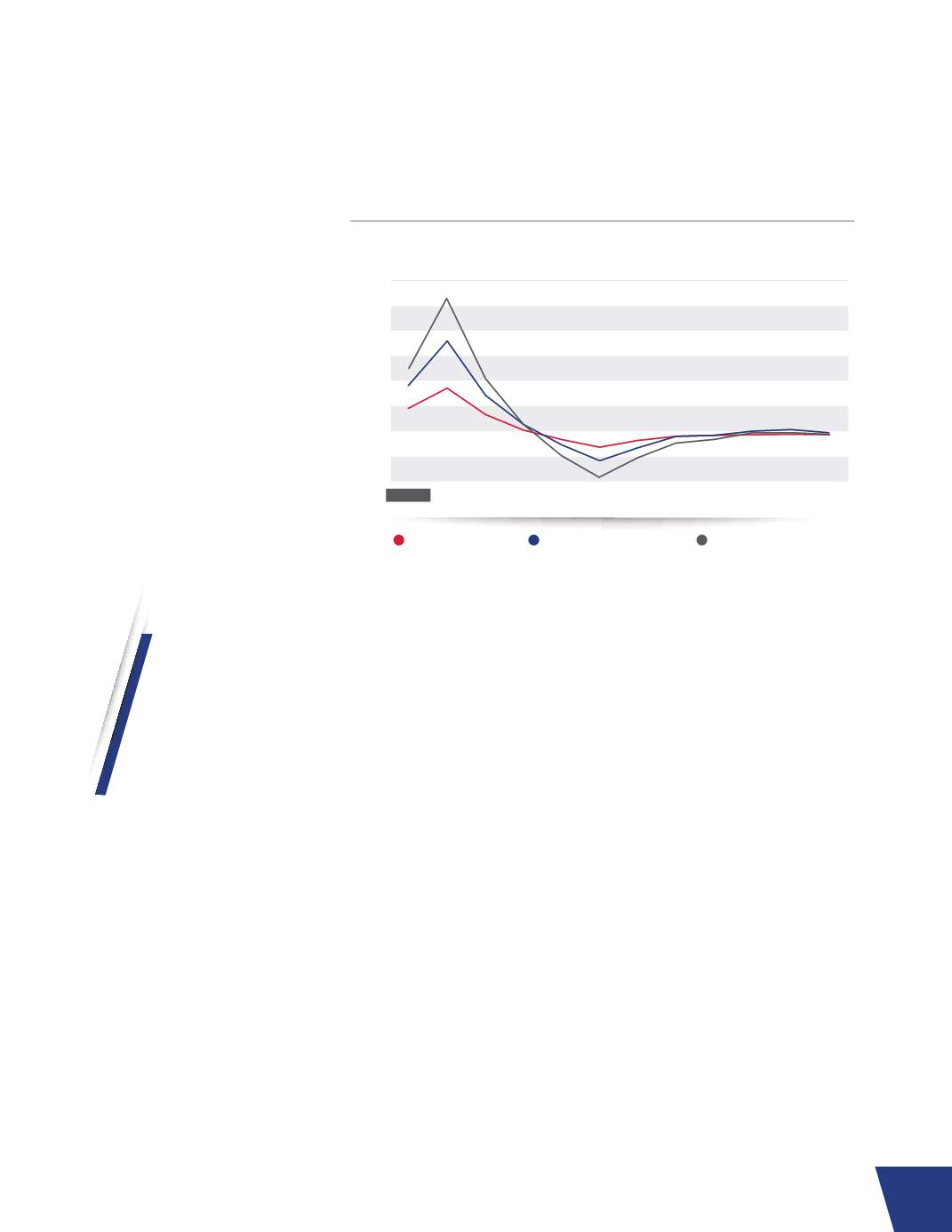

Gross profit margin

Operating sales margin

Net sales margin

Profit margin